Our recent exposé on agency fees charged to schools generated much heated debate from schools, agencies and teachers.

Now it’s the teachers’ turn.

Here we’ll shine a light on the other side of the coin — agency supply teacher pay, and the often indecipherable fees, deductions and accruals that appear each week on the payslips of agency supply teachers up and down the country.

We’ll dive deep into what deductions mean, and what to look out for on your own payslip. It’s boring but important – by the end you may recognise something on your payslip that doesn’t look right.

The examples given below are taken from real payslips submitted to us by concerned teachers during the 2018-19 school year. They breakdown the fees charged up by agencies/umbrella companies up to the point of the teacher’s gross taxable income. Take a look at your own payslip, and if you find something troubling or that you’d like clarification on, get in touch with our team using the contact details below. Let’s begin.

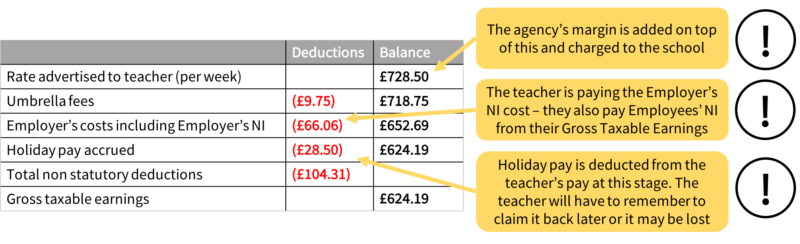

Example 1- Supply Teacher on a Long-term Agency Contract in London

Agency teacher on a long-term contract through a big, national supply agency at a primary school on the London fringe. This teacher is paid via a well-known umbrella company that is used by many other agencies nationally.

Supply Teacher Pay on a Long-term Agency Contract in London

Remember – this is a snapshot of deductions made before income tax, Employees’ NI, student loan repayments and other statutory deductions. There are three major concerns with this payslip:

- As we can see, there is a weekly charge of £9.75 levied by the umbrella company to process payroll. This is in fact at the low end — many umbrella companies charge £20 per week or more, adding up to £80 deductions a month.

- The payslip clearly states that Employer’s National Insurance is deducted from the advertised rate and is wrapped into something called ‘Employer’s costs’. This is in addition to statutory deduction of Employees’ NI. Teachers should not be paying both Employer’s and Employees’ NI.

- Holiday pay is ‘accrued’. Essentially this means that holiday pay is kept by the umbrella and then must be actively claimed back by the teacher. Sadly the deadline by which it must be ‘claimed back’ sometimes passes before the teacher has done so — meaning the umbrella company will not pay out the holiday pay even though it has been earned by the teacher.

All in all, these non-statutory deductions mean that this teacher’s gross pay is a massive £104.31, or a full 14%, below their agreed weekly gross rate of pay.

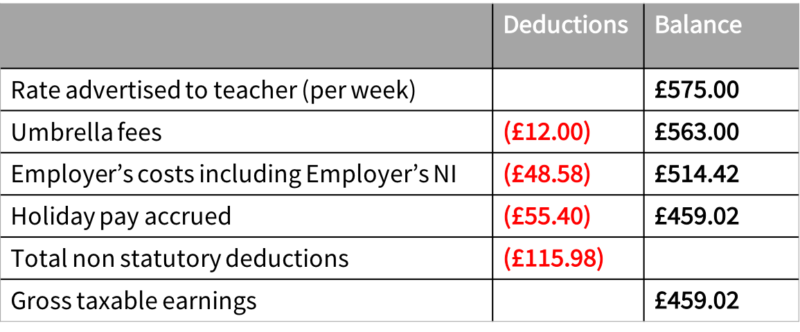

Example 2 – Supply Teacher on a Long-term Agency Contract in Birmingham

Agency teacher on a long-term contract through a big Birmingham-based supply agency at a nearby primary school. This teacher is paid via a well-known umbrella company that is different to the one in the first example, but that is also used by many agencies nationally.

Supply Teacher Pay on a Long-term Agency Contract in Birmingham

For the teacher, similarly troubling deductions to those on the first payslip can be found. Here, the teacher is missing out on £115.98 or 20% of their agreed weekly gross rate of pay.

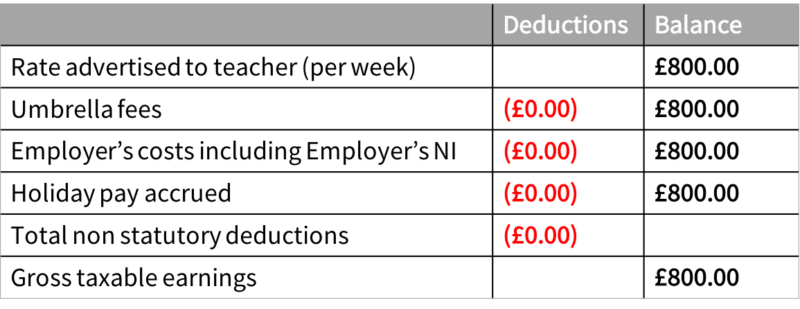

Teachers booked for work through Teacher Booker’s online platform are paid by our own in-house payroll company. This means teachers get three key benefits:

- There are no umbrella company fees

- Employer’s NI contribution is never deducted from the advertised rate — it is paid by the school and costs are calculated and clearly broken down to the school before a booking can be made

- Holiday pay is paid straight away, meaning there is no need to remember to claim it back at a later date

Example 3: Supply Teacher on a long-term contract through Teacher Booker

At a primary school in the London fringe area, this teacher is paid by our in-house payroll company, Teacher Booker Resourcing.

Supply Teacher Pay on a long-term contract through Teacher Booker

As can be seen, teachers working through Teacher Booker are significantly better off than working through the agencies as no deductions are taken from their pay. The above figures also do not take into account the agency’s margin, which is added on top of the agreed rate of pay to the teacher and is charged to the school, driving up the cost of agency supply teachers. If you think you may have been affected by the issues outlined above in the past, please get in touch at hello@teacherbooker.com with details of your situation. Even if you are on an agency contract currently, we may be able to help you negotiate a better deal.